2024 CPA Exam Changes

It looks like the CPA Exam is getting a major overhaul by 2024 as well.

The AICPA and NASBA recently announced their plans for the “CPA Evolution” initiative. As business practices evolve in our rapidly changing world, accountants must evolve, too. The two organizations gathered input about the skills needed for future CPAs from stakeholders like the State Boards of Accountancy. The intent is to make sure that future CPAs will have the competencies they need to meet tomorrow’s accounting challenges.

CPA Evolution

The CPA Evolution will be a significant effort. NASBA and the AICPA will revise the Uniform CPA Examination Blueprints. They will also work with universities to develop a curriculum that reflects the proposed changes to the CPA Exam. And finally, a new CPA Exam will launch by January 2024.

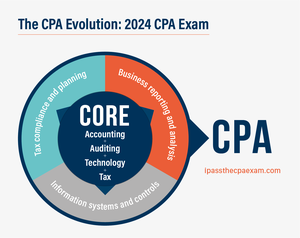

Core-Plus-Discipline Model

Under the changes, the path to CPA licensure will follow the new “Core-Plus-Discipline Model.” Candidates will need to demonstrate knowledge in accounting, auditing, tax, and technology as before. However, in addition to these core areas, CPA candidates will also need to show deeper skills in one of these three areas:

- Business reporting and analysis

- Information systems and controls

- Tax compliance and planning

Changes to the Format

The format of the revised CPA Exam probably won’t be finalized for a while. However, based on preliminary information, it looks like it will still be a 4-part exam. The first three sections will assess your knowledge in the core content, while the fourth will test one “discipline” (listed above) of your choosing. So, for example, if you’re strong in tax, you may want to consider the “tax compliance and planning” discipline.

One CPA License

Even though you’ll be able to choose from three different disciplines in the Core-Plus-Discipline-Model, there will still just be one CPA license. That is, your CPA certificate and title won’t reflect which discipline you chose to specialize in for the exam.

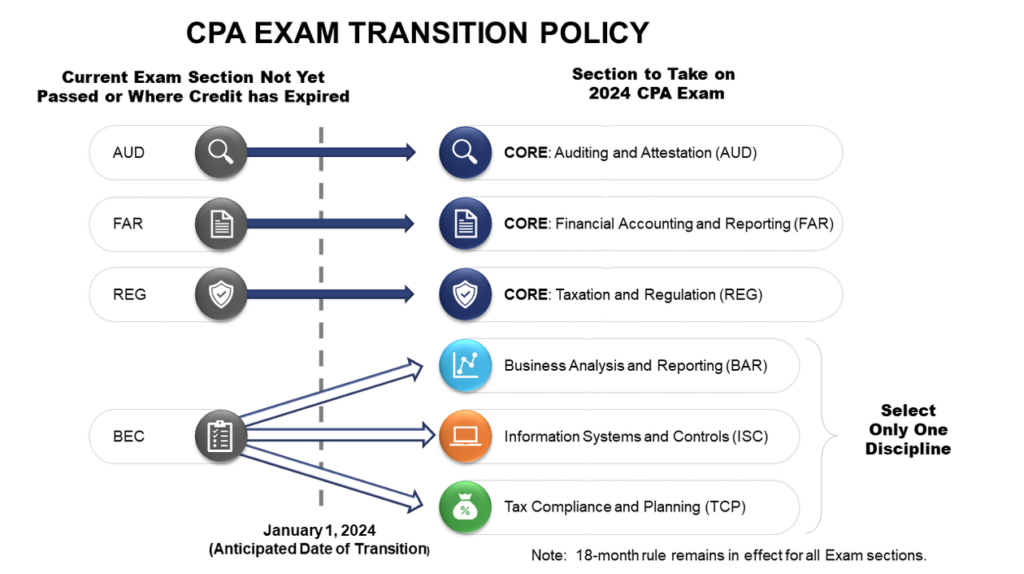

CPA Evolution Transition Policy

NASBA and the AICPA recently announced a new transition policy regarding the CPA Evolution initiative that will be implemented in January 2024. As NASBA notes:

The purpose of the CPA Exam transition policy is to allow you to continue your CPA Exam journey from where you are when we transition to the 2024 CPA Exam.

First of all, if you pass all four sections (AUD, BEC, FAR, and REG) before December 31, 2023, the CPA Evolution will not impact you.

However, if you will be in the middle of your journey, the transition policy will definitely affect you. For instance, if you pass one, two, or three sections before the end of 2023 and plan to pass the fourth in 2024, take notes about how the CPA Evolution will affect you. Basically, the transition policy maps out your path in case you don’t pass all sections prior to January 2024. And keep in mind that this is a hard cutoff—no exceptions will be given. You don’t have to worry if you plan ahead, though. Once the close turns over to 2024, you won’t lose your credits, as long as you’re still inside your 18-month rolling window and you follow the path outlined by NASBA and the AICPA.

Source: NASBA

Mapping your CPA journey: 2024 and beyond

As you can see from the chart above, the transition policy maps out your path if you plan to pass some of your CPA Exam sections after January 1, 2024. The good news is that you DON’T need to re-take your passed exam sections after 2024, as long as you’re still within your 18-month time frame.

Basically, you just need to remember that the “old” exam sections (AUD, BEC, FAR, and REG) loosely translate to “new” sections. Furthermore, some old sections (AUD, FAR, and REG) align with the new “core” requirement of the Core + Discipline model, while BEC is more related to the “discipline” requirement.

To put it another way, here’s how your 2023 CPA credits will be applied to the new Core + Discipline model:

- AUD credits will be applied to your core requirement of Auditing and Attestation

- FAR credits will count for the core Financial Accounting and Reporting requirement

- REG credits will transition toward the new requirement for Taxation and Regulation

- Unlike the other sections, your BEC credits will not count toward your “core” requirement but your “discipline” requirement instead. Furthermore, you can chose which of the three disciplines to apply your BEC credits. Your choices include: Business Analysis and Reporting (BAR), Information Systems and Controls (ISC), and Tax Compliance and Planning (TCP).

Additionally, keep in mind that NASBA clearly states that despite the transition, “the 18-month rule remains in effect for all exam sections.”

Questions about the CPA Evolution or Transition Policy?

I know that the 2024 CPA Exam changes can be a bit intimidating if you will be in the middle of your CPA journey during the transition. If you have questions, you can always drop me a line. Or, contact NASBA at [email protected].

What Does This Mean for You?

Basically, the CPA Evolution initiative means that the CPA Exam will change by January 2024. And since you will need to demonstrate your skills in the core content areas plus a sub-discipline, the CPA Exam could become much more challenging.

Therefore, if you are considering the CPA credential, I highly recommend that you pursue it as soon as possible before the exam changes. After all, I can’t imagine that these changes will lead to an easier exam. Rather, probably the opposite is true. Tasks formerly given to entry-level CPAs are often outsourced or completed with the help of paraprofessionals or specialized accounting software. Therefore, even CPAs at the beginning of their career are expected to have more problem-solving skills and the ability to think critically and apply professional judgment.